Backdoor Roth Ira Contribution Limits 2025

Backdoor Roth Ira Contribution Limits 2025. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira. In 2025 i made 2 $6k contributions to a traditional ira and converted it to a roth ira.

Here’s how those contribution limits stack up for the 2025 and 2025 tax years. If you use the mega backdoor roth strategy, how much you can save is limited by the annual caps on 401(k) contributions.

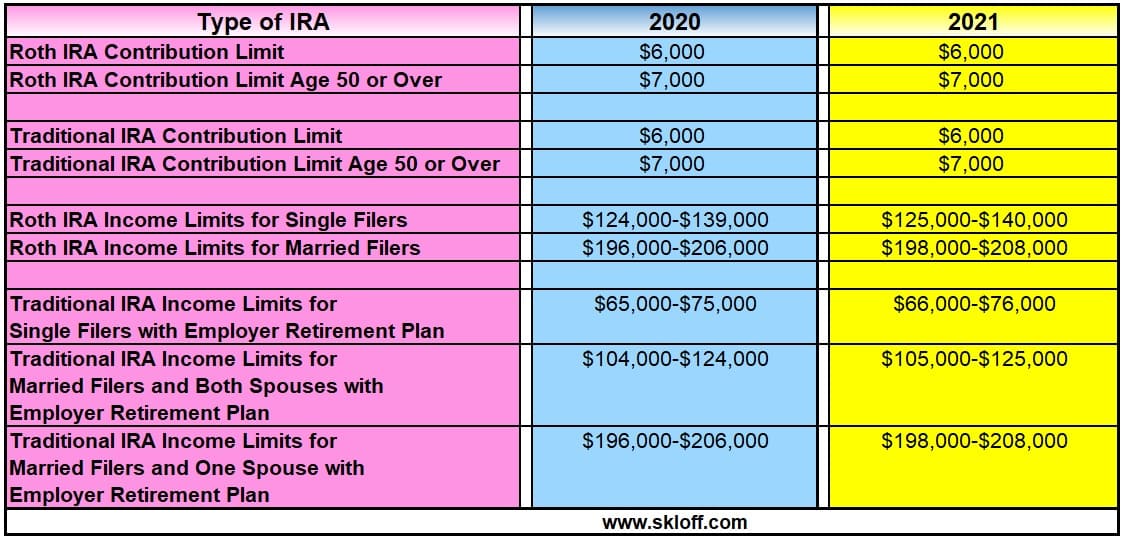

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, Find out if your modified adjusted gross income (agi ) affects your roth ira contributions.

Roth Ira Contribution Limits 2025 Tax Agata Ariella, How much can you convert to a backdoor roth?

Roth Ira Contribution 2025 Over 50 Karol Martita, This table shows whether your contribution to a roth ira is affected by the.

Non deductible ira limits 2025, How Much Can You Contribute to Your IRA, Roth 401(k) contribution limits for 2025 retirement plans the roth 401(k) contribution limit for 2025 is increasing, and workers who are 50 and older can save even more.

Roth Ira Limits 2025 Limits 2025 Eliza Jobyna, If your modified adjusted gross income (magi) is above certain income limits, then the amount you can contribute to a roth ira is phased out.

Ira Limits 2025 Over 55 Lindy Samaria, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

Max Ira Contribution 2025 Roth Ira Conversion Uta Libbey, The roth ira contribution limits are $7,000, or $8,000 if you're 50.

Traditional ira deduction limits 2025, If you use the mega backdoor roth strategy, how much you can save is limited by the annual caps on 401(k) contributions.